Invisible Redistribution to Weaker Economies? The Case for EU Automatic Stabilizers

The Greek financial crisis seems finally to have been overcome, thanks to emergency European Union (EU) and International Monetary Fund (IMF) lending to the Greek government. Bondholders will have been punished, too, losing 75 percent of their capital in the transaction, and Greece itself will continue to be yoked to austerity budgets (which some would argue may not be the best economic policy for the country or even the debt holders.)

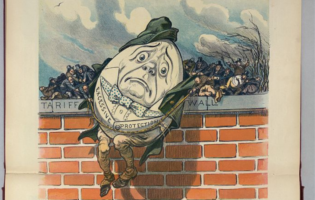

Unfortunately, the mutters of “just kick the Greeks out” of the euro have been muted but not eliminated. These “solutions” to the Greek problem have been heard in the German press for the last year (e.g., Schäuble in the FAZ on March 19, 2010), and much of this sentiment is a political backlash to Chancellor Angela Merkel’s continued support for Germany paying to keep Greece afloat. The German press corps has been actively interpreting what the various bailout plans mean for the Germans, and thus most Germans are acutely aware that they are lending Greece approximately €2,000 per household. Couple that with ugly stereotypes of Greeks as corrupt and lazy, and the backlash is a textbook example of how politicians are constrained by populism even in a country that deliberately avoids reacting to it.

Although understandable on an emotional level, the calls for Greece to quit the euro or the EU are misguided, and represent a fundamental misunderstanding of what the EU has become. Essentially (although a lot of academic ink has been spilled on the nuances of this question) the EU has become the most state-like federation that has existed in the modern era. Thus the EU is more like the U.S. than like the WTO, with significant and complex interdependencies that represent thirty-plus years of intertwining. The relevant answer to the question of whether Greece can or should leave the EU is what other federal countries would do in a comparable situation.

Redistribution in the United States

One example would be the United States. As most students of American government know, almost all U.S. states have balanced budget amendments that preclude them from running up such levels of debt, and thus the comparison is not particularly apt. Although true, this is only half relevant: yes, the states’ debts could not have reached Greek levels, requiring a bailout, but on a more economically fundamental level, there are U.S. states that continue to be subsidized by the others, year after year, because they are less economically viable. The Greek debt, now that it has been rolled over, is not the reason why some economists (e.g.. Paul Krugman) keep calling for Greece to leave the euro. Those calls are based on the idea that the Greek economy—going forward—will not be able to be as productive as its membership in the euro demands, and thus it is condemned to low growth and debt. Austerity programs imposed by the EU will make these fundamental issues worse. Their answer is that Greece needs to leave the euro and devalue its currency to revitalize its economy.

But is it the case that all states in an economic federation have to be equally productive in order to be in the same currency union? Clearly not, and one can think of other examples from disparate federal countries. Yet these states continue to exist in these countries, and no one asks to kick them out for economic underperformance.

In order to illustrate this more fully, the state of Mississippi will be selected to represent the U.S.’ version of Greece. As some of the statistics in the Box 1 show, Mississippi and Greece share some of the same problems of relative poverty and corruption. What is notable, however, is that there have been no economists calling for the ouster of Mississippi from the U.S., or at least from the dollar, so it could devalue its currency and be able to compete more effectively. And obviously, a significant number of Americans would be outraged at the suggestion that a state should leave the union because of economic underperformance. More surprising, is that citizens in other states send $25.7 billion to Mississippi every year without any public outcry over the “deadbeats.” That money is not even a loan that one could hope would be paid back (as the Germans and the rest of Greece’s creditors are hoping). How can we explain that?

The answer is that these are cash flows from and to individuals (for the most part) who happen to reside in states like Mississippi. When people send money they do not send to a specific individual or state and thus the tax-antipathy is directed only at Washington, DC. These so-called automatic stabilizers channel money from individuals and corporations throughout the U.S. into Washington, DC, and then to recipients throughout the U.S., again without much or any political involvement in the Congress.[1] The main flows are categories like Social Security payments to retirees, Medicare, unemployment, and other cash assistance to individuals, but there are also military bases and federal lab funds that get funneled to Mississippi. These have more of a political origin, but are not decided on an annual basis, and therefore more invisible.

Economists like these cash flows because they can stabilize economic changes more quickly than fiscal policy through Congress can. For example, if Michigan is in an economic slump, fewer people and corporations there will be paying federal income taxes, and more will be drawing federal unemployment benefits and Medicaid, thus keeping some purchasing power in the Michigan consumers’ pockets. But there are also political advantages for the federation as well. Because these cash flows are opaque they represent citizen solidarity without giving an opportunity for bias and stereotyping.

If economists construe automatic stabilizers solely as real-time smoothing mechanisms of the business cycle, it would imply that all states will sometimes be in a net payer and sometimes in a net receiver position. As Figure 1 makes clear, however, some states spend decades as net receivers and others as net payers. In other words, the U.S. is made up of states that perpetually support other states, and those—like Mississippi—that perpetually rely on subsidies from others. And all without a long political discussion about the merits of subsidizing one state or another.

Arguably, this is the “transfer union” model that the EU needs to move toward in order to maintain the integrity of twenty-seven very disparate economies. In addition to the speed of transfers, two key parts of the automatic stabilizer model are important for diverse Europe: 1.) the flows are mainly individual-to-federation-to-individual, thus breaking the iron metric of the state within the EU and 2.) they are politically invisible transfers because the parameters are agreed upon once and then happen automatically.

One of the challenges in the EU has been to move away from a model of a confederation of states and toward a “citizens’ union,” but there has been progress in that direction. This issue has been at the heart of the decisions to allow second referenda when, for example, Ireland rejected the Lisbon Treaty. In a union of states, the rejection by one should have meant the end of the Treaty, but EU and national governments agreed that 4.5 million citizens in one state could not thwart the will of 300 million citizens of the rest of the Union, and therefore the referendum should be run again. This point of view prevailed.

There is also the right of EU citizens to exercise their right to vote and to stand as a candidate either in the EU country of residence or in their home country. Again, this represents a movement toward using the individual citizen as the fundamental democratic unit rather than the state. EU automatic stabilizers would reinforce that trend by granting benefits such as pensions and health care to individuals regardless of where they reside. By sending benefits directly to the individual, the EU also reduces the perception that some of its largest programs like the Common Agricultural Policy disproportionately benefit wealthy states and corporations, enhancing the EU’s reputation as an honest broker.

It is the second attribute—political invisibility—that is key for a heterogeneous state, as shown by the economic crises in the EU. Automatic stabilizers redistribute invisibly. The redistribution, however, is targeted more precisely and effectively than even EU regional cohesion funds or other geographically-based redistribution. By funding individuals rather than states, automatic stabilizers also reduce the moral hazard of redistribution: the fear that a rational state will not keep to a realistic budget, for example, by raising taxes to fund expenditures, knowing that some of the shortfall will be made up by transfers from the federation.

Redistribution Within Germany’s Länder

The idea of moral hazard has been a source of criticism of Germany’s hybrid redistribution system, Länderfinanzausgleich, in the past, but empirically has not been shown to be an important factor in the budget because of the size of the flows as a percentage of the overall budget. However, the transfers remain a source of political tension between the states, as shown by recent calls to revamp the system again.

It is important to remember that Länderfinanzausgleich is mandated by the German Basic Law, and thus the states are not free to overturn the law. The formula for the transfers has been challenged by states in the courts, and in 2005 the formula was changed to reflect some of the points addressed in the lawsuit. More importantly, the new formula explicitly attempted to avoid the moral hazard problems of the earlier system by making a premium calculation based on productivity growth and population. Nevertheless, the net payer states remain the ones that have historically been net payer states: Bavaria, Baden-Württemberg, Hessen, and Hamburg have all been net payer states since 2005, and Nordrhein-Westfalen was a net payer in all but one of those years.

The net payer states have made an issue of the existing system every year since the 2005 revisions, in January 2012 going so far as to threaten to take the net receiver states to court for not reducing their structural deficits. What is relevant for the purpose of this study, however, is how small the per capita sums involved are, relative to the amount of political heat they generate. In 2010, the citizens in the net payer states paid in the range of €0.20-2.39 per person, while the net receiver states’ citizens benefited in the range of €0.37-4.53 per person. Contrast that to the amount the U.S.’ automatic stabilizers redistribute to Mississippi: $8,620 per person without any political name-calling!

The net payer states have made an issue of the existing system every year since the 2005 revisions, in January 2012 going so far as to threaten to take the net receiver states to court for not reducing their structural deficits. What is relevant for the purpose of this study, however, is how small the per capita sums involved are, relative to the amount of political heat they generate. In 2010, the citizens in the net payer states paid in the range of €0.20-2.39 per person, while the net receiver states’ citizens benefited in the range of €0.37-4.53 per person. Contrast that to the amount the U.S.’ automatic stabilizers redistribute to Mississippi: $8,620 per person without any political name-calling!

Redistribution in the European Union

Similar to Germany’s system, existing EU redistribution is small (1.12% of GDP) and consists mainly of agriculture and sustainable growth policy, comprising competitiveness and cohesion for growth and employment. The €67.5 billion is disbursed based on regional characteristics and seeks to ameliorate regional disparities in the name of citizen solidarity. The state remains the primary conduit for those projects. The only other existing transfer of money from Brussels to EU member states is through the Common Agricultural Policy. Administered by the member states, the money does flow to individual farmers, but not in an egalitarian fashion because of political interventions and bargains struck during enlargement. Thus, these flows have served to exacerbate regional disparities.

More importantly, these flows have served to undermine the legitimacy of the EU because the composition of net payer and net receiver states has been fixed for some time. In net payer states, the budgeting negotiations inevitably involve reining in spending in the EU, while net receivers view the financial commitments as sacrosanct. The public arguments of the two sides serve to highlight divisions in the EU that are disproportionate to the size of the actual financial flows.

Automatic stabilizers in the EU could be used to supplement existing national programs like pensions or medical care, not substitute for them. Indeed, many of the programs that could be moved from the state to Brussels (at least in part) are in issue areas in which cross-border problems have been noted already. In the area of pensions, for example, different vetting schedules and lack of portability have stymied labor mobility throughout Europe. Creating an EU-wide minimum pension that could be supplemented at the state level would reinforce the notion of one market, and free movement of people. Conversely, in health care and in education, mobility (e.g., retirees in Spain or German medical students in Austrian universities) have created problems for national health care and education systems. Many observers believe the long-term solution is EU-wide benefits that move with the individual. For the U.S., Social Security and Medicare are the largest two automatic stabilizers. For Europe, the establishment of these mechanisms would not only help by being invisible redistribution channels, but would also solve some of the financial and logistical problems associated with the free movement of people.

Much of the foregoing discussion has left unaddressed a fundamental question: why should the EU prefer to keep Greece in the Union? Given the costs of redistribution, why should Europeans care whether Greece remains in the Union (and by analogy, why would Americans prefer to have Mississippi in the U.S., Canadians to have the Maritimes, etc.)? On this question, there is remarkably little discussion, beyond historical path dependency-type explanations. The notion that “Greece is the cradle of European Civilization” is perhaps true, but for many it is not an extremely compelling reason to pay for the state to remain in the Union.

Economists Alesina and Spolaore[2] argue that borders between countries are “thick,” meaning that they constrain trade and investment even among close allies with free trade such as the U.S. and Canada. Thus even in a free trade world, the size of countries matters to obtaining the economies of scale involved in administering a large economic unit.

For other countries with unfriendly borders, having a larger population acts as a deterrent to potential aggressors. Having Greece within the EU (or the former East German Länder within Germany) prevents another power from creating a military alliance with it thus giving it a beachhead in the federation. Having access to Greece’s natural resources through the common market also means that Europeans pay lower costs for those items than if Greece were outside the Union.

Finally, millions of European citizens can and do visit, work, study, or even retire there without a visa. Many Europeans take these advantages for granted, and would miss them if they were gone.

But for those who still do not see the utility of having Greece in the EU, the role automatic stabilizers could play would be essential to the smooth functioning of the internal market. Sometimes transparency is not the best policy in large, heterogeneous federations. Just ask the Americans.